Good Saturday Morning Chart Fans!

I remain on watch for those head and shoulders tops (ones that haven’t yet broken and ones that have) but I also continue to watch stuff like XME and Transports that haven’t broken to lower lows (yet!)

DJIA

Transports. There was no bounce from that election gap fill.

Utes. The Broadening Top is still in place.

SPX. The h/s top is there. As is the unfilled gap.

Naz

IWM

QQQ

QQQJ. Have been outperforming the QQQs (higher lows). But have a h/s top in place now. If this breaks I think the speculative bubble will too.

IGV. Just like that, down 10%+. No wonder no one is chatting it up anymore.

XLI

XLV

XLP

XLY. This will probably be my last time posting this. Useless chart, may as well just post TSLA.

XLE. Walter Deemer says energy is the last to rally.

OIH

XME. No lower low (yet!)

XBI

URA

PALL. Has my interest.

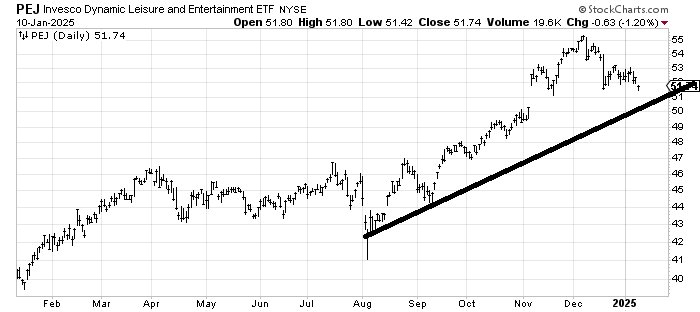

PEJ. An old Conor Sen fave. Thought we could check in on the consumer with this instead of XLY

ITB. As awful as they have been, no lower low (yet)

IYR. I remain shocked this is so far from the spring low.

SOX. Range bound for months. Respect a break in either direction.

Bank Index. No lower low (yet) and that gap is there.

KWEB. Broke on Friday.

LIT. Hope springs eternal.

VGK. Still hasn’t broken the FOMC low. Yet.

GLD. Like the SOX, been home on the range.

McClellan Summation Index. The fish hook is gone.

Bondaleros. Yield on 10 Yr.

DXY.

Insiders. They are back to selling.

Citi Panic/Euphoria. Remains in Euphoria

Just because folks are talking up inflation here is a chart of inflation in the 1970s/80s for reference.

Great job Helene, thanks for sharing

“XLY. This will probably be my last time posting this. Useless chart, may as well just post TSLA.” —Best comment of the week by a landslide