Good Saturday Morning Chart Fans!

We remain Home on the Range in most charts. I suspect if the big cap indexes can break out to the upside folks will say it was those cup and handle patterns that showed up. Otherwise, the non-US markets have been much better in 2025.

DJIA.

Transports. Had quite a day Friday.

Utes. The triangle feels wrong as we’re too far into the apex for us to trust a breakout. They still refuse to get up to that 1040 spike.

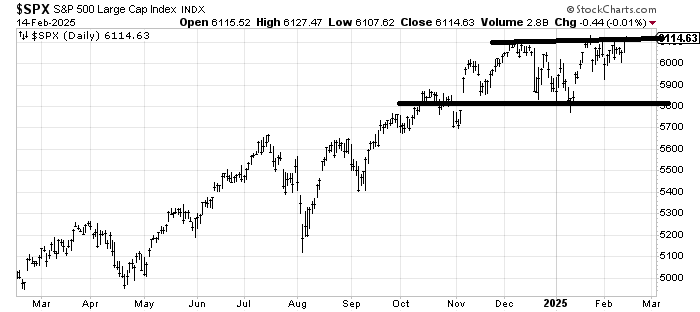

SPX

Naz

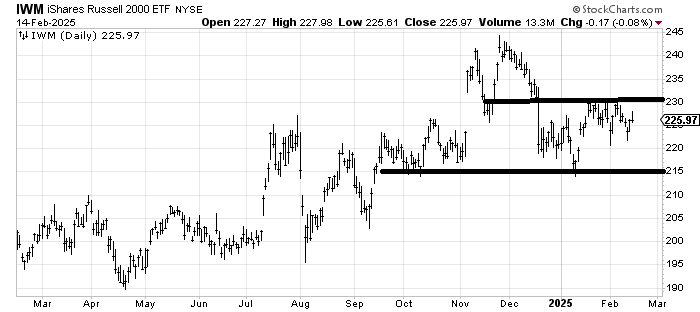

IWM

QQQ

QQQJ. Juniors continue to do well. Very different than last year.

XLI

IGV. The h/s bottom worked. Now the neckline must hold.

XLE

OIH. Like the SOX, range bound for months.

SOX

Bank Index

XLP. The neckline must hold.

XLV. For now it is mapping out as I asked it to do last week. Time will tell if that is the correct view.

XBI. Tenuous but a possibility.

ITB. Held support. See last week’s missive for the bigger/weekly view.

IYR. Continues to hang in there but resistance is still strong.

URA

LIT. It’s trying!

PALL.

GLD

VGK. I offer the weekly chart as well. On that chart you can see what the longer term measured target would be. Near term the old high is resistance.

KWEB. Gotta show that weekly cuz, welp, what a base.

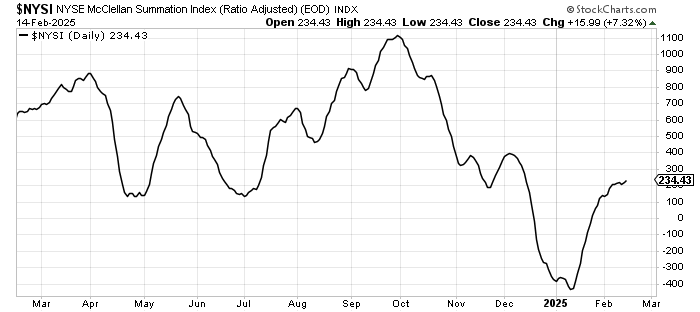

McClellan Summation Index. Sideways.

DXY. 106 is big support.

Bondaleros. Yield on the 10 yr. Acted like a chicken with its head cut off this week.

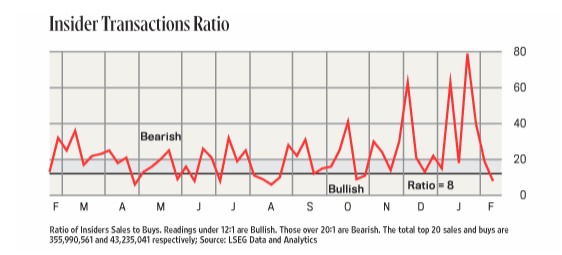

Insiders. Finally came down.

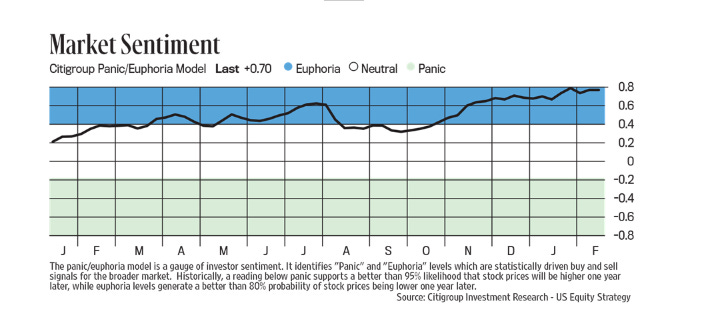

Citi Panic Euphoria. Remains in Euphoria. As noted last week, stayed up there for nearly two years in 1999-2000.

“XLV. For now it is mapping out as I asked it to do last week. Time will tell if that is the correct view.”- How is it no one commented on this brilliant post? Helen’s take on the Utes is a close second. Thank you for fabulous chart fest!

Great work!