Good Saturday Morning Chart Fans!

The same wide ranges that were in place last week are still in place. Take a step back and there is one thing that sticks out: only two charts got back to the old highs like the SPX/DJIA did: GLD and Banks. That’s it.

DJIA

Transports. At least they filled that gap below.

Utes.

SPX. Same range. 3 months now.

Naz. Underperforming the S&P so far in 2025

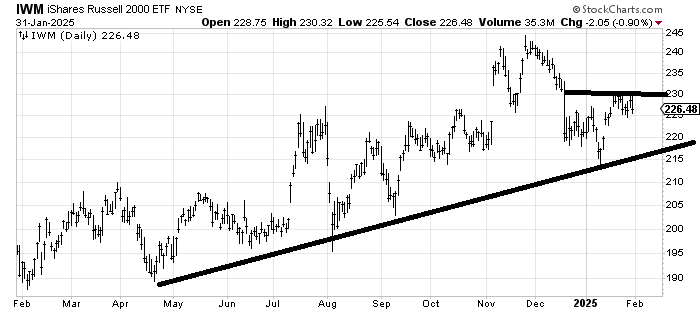

IWM

QQQ. Filled the gap from last Monday. Second lower high (for now)

QQQJ

IGV. If it holds 100 on this trip down then maybe there is a little h/s bottom there. Maybe.

XLI. Couldn’t even fill Monday’s gap down.

SOX. Like the buffalo, it is home on the range. For now.

Bank Index. Got to the highs.

XLV. It is possible that a pullback to that line would form a h/s bottom over next few months.

XLP

XLK. Throwing this one in only because I would point out it is actually lower than where it was last summer.

XLE. Talk about a wide range.

OIH.

XME

URA

PALL. Continues to catch my eye.

LIT

ITB. See last week’s comments because I would simply reiterate them.

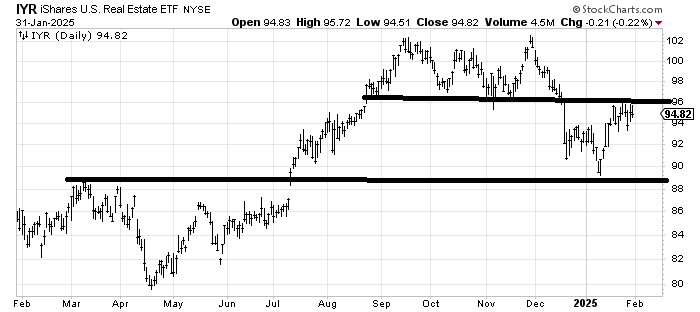

IYR. Holding up relatively well but that’s a lot of resistance to contend with.

GLD.

KWEB

VGK. Europe may be a mess but it made a higher high than December. Watch the blue line.

DXY.

Bondaleros. Yield on the 10 yr. I want it to touch the uptrend line. It doesn’t want to.

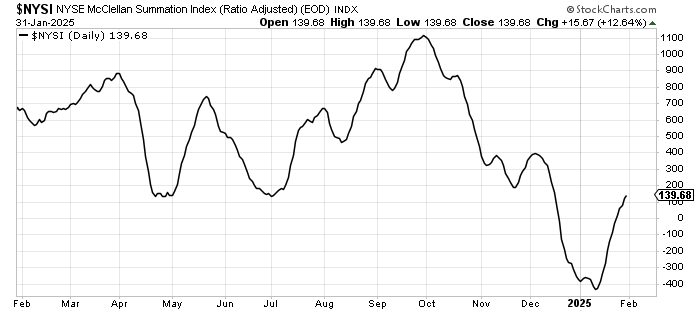

McClellan Summation Index. Still heading up.

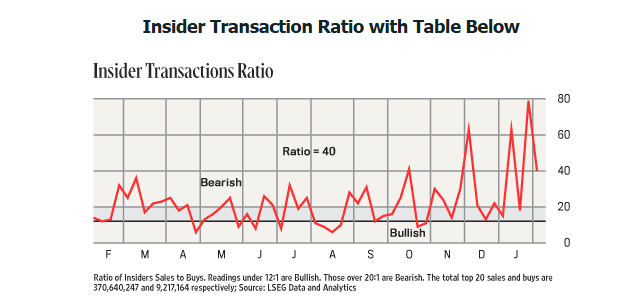

Insiders. Backed off but not enough to get under 20

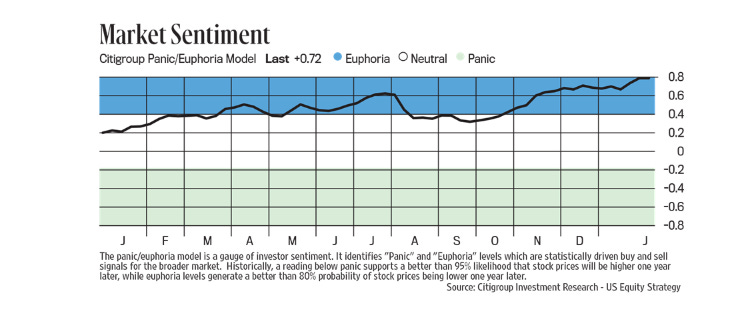

Citi Panic/Euphoria. Literally off the chart.

The books say that for it to be a double top it needs to break the valley between. That's the bottom of the range. For me I just focus on the range.

Thanks Helene! A lot of double tops: DJIA, SPX, QQQ (although lower second top), banks, XLI. Am I wrong?